Corporate Philosophy

Message from Top Management

Coexistence of “responding to changes in the current environment” and “preparing for sustainable growth”

The global economy during FY2020 was impacted by the spread of COVID-19 infection throughout the entire fiscal year; notwithstanding, the economy in China recovered quickly primarily in the manufacturing industry, and business conditions in other overseas regions also improved from the latter half of the fiscal year with capital investment demand on a recovery trend. In Japan, although there were signs of recovery in some industries such as semiconductors at the end of the fiscal year, full-scale demand did not recover.

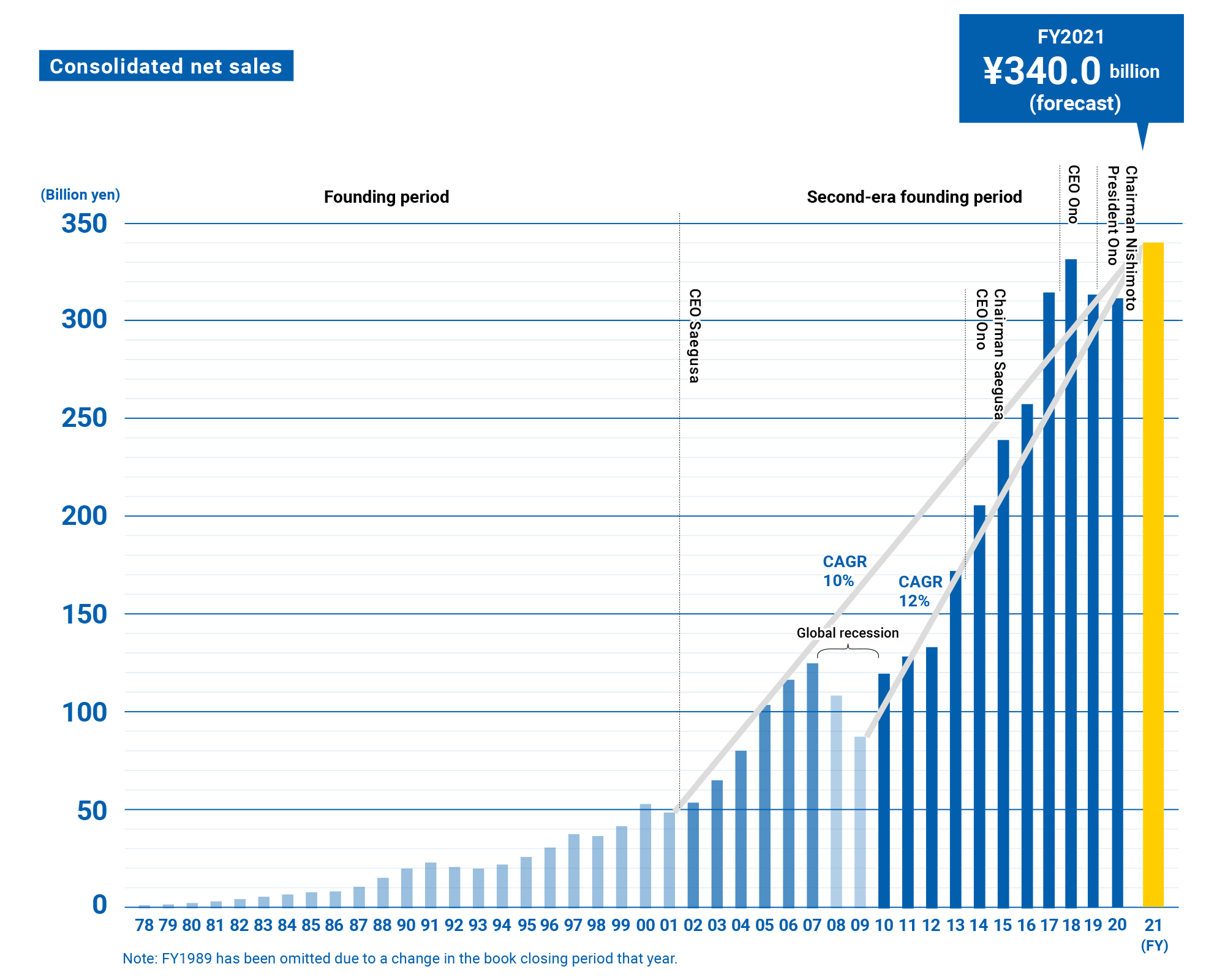

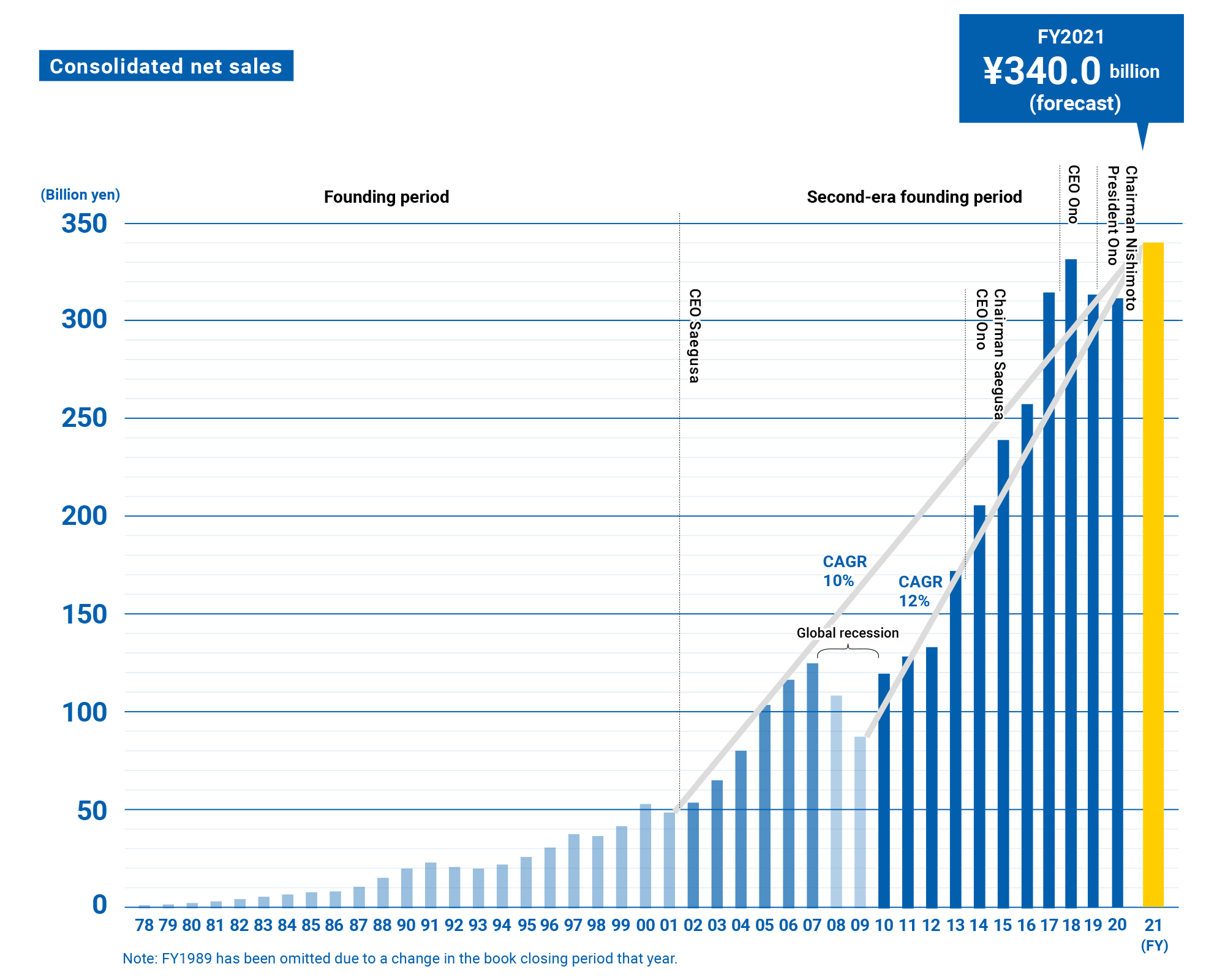

Under this environment, MISUMI Group is leveraging its unique business model, which encompasses both manufacturing and distribution businesses, and by advancing the business foundation that supports these businesses globally, we are contributing to the manufacturing industry worldwide by responding to customer’s reliable quick delivery needs. Amidst the continued impact of COVID-19, we continued to steadily provide products meeting customers’ reliable and quick delivery needs, by fully utilizing the strong business foundations built to date in IT, logistics, and production; as well as leveraging the global network. Although demand of overseas regions recovered gradually throughout the year, consolidated net sales were ¥310,719 million, a decrease of 0.8% year-on-year due to the impact of sluggish business conditions in the first half.

By segment, net sales in the Factory Automation (FA) Business were ¥102,244 million (2.9% increase year-on-year), reflecting the shift to a recovery trend in all regions in the latter half of the fiscal year in addition to China’s strong performance throughout the year. In the Die Components Business, although the automobile-related business showed a gradual recovery in the second half, it could not compensate for the shortfall in the first half, net sales came to ¥66,871 million (7.7% decrease year-on-year). In the VONA Business, despite the impact of sluggish capital investment in Japan, overseas sales were favorable on the whole, owing to reliable quick deliveries being bolstered as well as the cultivation of new customers. Net sales were ¥141,602 million (0.1% increase year-on-year).

In terms of profits, significant increase secured due to the effects of thorough profitability improvement measures, such as fundamentally eliminating inefficient operations, while carefully selected and continuing upfront investment essential for sustainable growth.

Consequently, operating income was ¥27,199 million (15.1% increase year-on-year), ordinary income was ¥27,189 million (17.0% increase year-on-year), and net income attributable to owners of parent was ¥17,138 million (3.8% increase year-on-year).

Aiming for record highs in both sales and profits by further refining our global reliable and quick delivery

It is expected that the global economy and the Japanese economy will continue to face uncertain business environments caused by the impact of the prolonged spread of COVID-19 infection and the US-China conflict. In the industrial sector, demand for automation is expected to increase globally.

To meet these customer needs, we will continue to advance our IT, logistics, and manufacturing business foundations and further refine our "global reliable and quick delivery".

In addition, we will accelerate the shift of resources to businesses with higher growth potential and profitability, and strive to innovate the business models in anticipation of transitions occurring in the post-corona market structure, as well as changes in the competitive environment.

Principal initiatives for FY2021 are as below.

We will accelerate business expansion in meviy service, which enables instant quotations, and shipping in as early as one day, by simply uploading product design data in 3D CAD. Until now, we have operated this service in Japan, and the number of users exceeded 55,000. We will build on our achievements to date, including progress in developing an unconventional customer base, and start the global rollout.

In addition, RAPiD Design, a tool for facilitating equipment design stores around 4.5 million items of 3D CAD data on mechanical components for factory automation. Its worldwide users have exceeded 100,000, and it is making a steady contribution to generating new sales overseas, particularly in China. Furthermore, in FY2020 we started handling the CAD data of other manufacturers. Customers can obtain data on components from multiple manufacturers all at once, enabling them to greatly improve their design processes.

In the distribution business, we are augmenting our range of competitive private-brand products in China, and will continue to expand going forward. We will strengthen the competitiveness of our products, focus on a product lineup unique to MISUMI. We will be promoting the development of a range of products lineup and service provision that cater to the demand and characteristics of industrial automation customers.

As for our business foundation, we will renew our core system and implement automation systems into our logistics sites. We will fundamentally renovate the core system, which forms the heart of the MISUMI business model, and introduce the updated system worldwide from the end of this fiscal year through FY2023. Meanwhile, we will bolster our efforts to undertake agile service development with a 3-fold increase for development speed of new functions and at 1/3 of the development cost. In our logistics sites, we will target further enhancement of productivity by introducing automation systems and renewing operations in U.S., east Japan, and China in addition to central Japan and Europe.

Based on these measures, in FY2021 we forecast net sales of ¥340.0 billion, operating income of ¥38.0 billion, and net income attributable to owners of parent of ¥27.4 billion.

Anticipate dividend for FY2021 to reach a record high

MISUMI Group’s fundamental policy is to enhance returns to shareholders by increasing profits available for dividends through sustainable growth. As for dividends, the benchmark for our dividend payout ratio is currently set at 25%. Accordingly, we set a year-end dividend of ¥9.18 per share for FY2020. The annual dividend is ¥15.09 per share, an increase of ¥0.54 year-on-year.

For FY2021, we are currently anticipating an annual dividend of ¥24.11 per share. This will be an increase of ¥9.02 (+59.8%) year-on-year and is expected to reach a record high.

Representative Director and Chairman

Kosuke Nishimoto

Representative Director and President

Ryusei Ono

Sales of MISUMI Group